How Pay-Per-Mile Might Change UK Car Ownership

The UK’s motoring landscape is on the brink of a fundamental shift. Pay-per-mile schemes are gaining serious traction, with the government exploring options that could completely reshape how we think about car ownership, driving habits, and vehicle costs.

While pay-per-mile car insurance already exists through providers like By Miles, the bigger conversation centers around pay-per-mile road taxation: a system that’s been debated for over 15 years but never implemented. With electric vehicle adoption rising and fuel duty revenue declining, this concept is moving from “maybe someday” to “probably inevitable.”

But what would this actually mean for UK drivers? Let’s break down the real implications.

The Current Pay-Per-Mile Landscape

Right now, we’re dealing with two distinct concepts that often get confused:

Pay-per-mile insurance is already here. Companies track your actual mileage and charge accordingly, with low-mileage drivers (under 7,000 miles annually) seeing genuine savings. Data shows drivers in the 6,000-6,999 mile range pay around £612 annually for this type of coverage.

Pay-per-mile road tax remains theoretical. The most commonly proposed rate sits around 15p per mile, which would dramatically alter the cost structure for most drivers. Someone driving 10,000 miles yearly would face £1,500 in road tax alone: compared to the current standard Vehicle Excise Duty of £195.

Financial Winners and Losers

The mathematics here are stark and unforgiving. Pay-per-mile would create clear financial winners and losers based on driving patterns rather than vehicle value.

Low-mileage drivers would see immediate benefits. Urban commuters with good public transport access, retirees who drive occasionally, and anyone clocking under 7,000 miles annually would pay significantly less than current fixed-rate systems.

High-mileage drivers face a harsh reality check. Rural commuters, traveling salespeople, and anyone regularly covering long distances would see costs skyrocket. A driver completing 15,000 miles annually could face £2,250 in road tax alone under a 15p-per-mile system.

Commercial operators would need complete cost restructuring. Fleet managers would suddenly have direct financial incentives to optimize routes, reduce unnecessary journeys, and invest heavily in fuel-efficient vehicles.

The savings for electric vehicle owners through salary sacrifice schemes would remain substantial even under pay-per-mile taxation. Rural drivers covering 12,000 annual miles would still save £805 compared to petrol equivalents, despite higher per-mile charges.

Behavioural Changes: How We'll Drive Differently

Pay-per-mile creates immediate feedback loops that don’t exist with current fixed-cost systems. Every journey becomes a conscious financial decision rather than something you’ve already paid for.

Journey consolidation would become standard practice. Instead of multiple trips to different shops, drivers would plan efficient routes covering all errands in single journeys. This isn’t just theoretical: telematics data from existing pay-per-mile insurance users already shows this behaviour.

Public transport adoption would accelerate in areas with viable alternatives. Urban dwellers with reliable bus and rail connections would increasingly view private vehicles as expensive backup options rather than primary transportation.

Carpooling and ride-sharing would expand beyond environmental consciousness to economic necessity. When four people can split a £3 journey cost instead of each paying separately, the mathematics become compelling.

Off-peak travel might receive differential pricing structures, encouraging people to shift non-essential journeys to less congested times.

Regional and Social Equity Concerns

This is where pay-per-mile gets politically complex. The system would create geographic and occupational disparities that current flat-rate systems don’t impose.

Rural communities face the harshest impact. Areas with minimal public transport would see residents forced to pay premium rates for essential journeys. A rural dweller driving to the nearest supermarket, doctor, or workplace would face the same per-mile rate as someone choosing to drive in central London despite having extensive transport alternatives.

Essential workers present particularly challenging scenarios. Home carers, community nurses, mobile tradespeople, and rural service providers would face substantially higher operational costs despite providing necessary services. The RAC has specifically warned against systems that “disproportionately impact those who have no viable alternative to car travel.”

Age demographics would be affected differently. Younger urban professionals might benefit significantly, while older rural residents could face financial hardship from essential travel costs.

Vehicle Ownership Structure Evolution

Pay-per-mile would fundamentally alter vehicle ownership patterns beyond simple usage changes.

Subscription and sharing models would become increasingly attractive. High-mileage users might shift toward car-sharing services, subscription-based access, or enhanced public transport passes rather than private ownership.

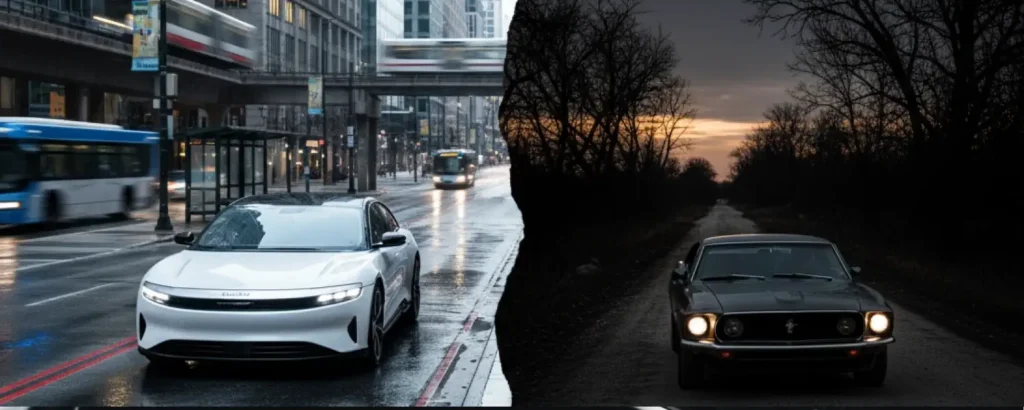

Vehicle selection criteria would prioritize efficiency above all else. Fuel economy, electric powertrains, and hybrid systems would become primary purchasing factors rather than secondary considerations.

Multi-vehicle households might restructure completely. Families could maintain one efficient vehicle for high-mileage journeys and rely on alternatives for shorter trips.

Commercial fleet optimisation would drive rapid adoption of route planning software, telematics systems, and efficiency monitoring tools. Fleet operators would need to justify every mile to maintain profitability.

Technology and Monitoring Implications

Pay-per-mile requires sophisticated tracking systems that raise important questions about privacy, accuracy, and tampering resistance.

Current pay-per-mile insurance uses smartphone apps and plug-in devices to monitor mileage. Road tax implementation would require more robust systems capable of handling the entire UK vehicle fleet without creating administrative burdens.

This technology infrastructure presents both opportunities and challenges for drivers seeking to manage their mileage costs effectively. Some may explore various approaches to influence recorded mileage data, though it’s crucial to understand that tampering with official government tracking systems would carry serious legal consequences.

Environmental and Congestion Benefits

Pay-per-mile aligns financial incentives with environmental goals in ways current systems don’t achieve.

Reduced discretionary travel would lower overall emissions. When every mile carries direct cost, people naturally eliminate unnecessary journeys.

Modal shift acceleration would benefit public transport systems through increased ridership and revenue.

Urban congestion reduction could result from pricing that reflects the true cost of road usage in busy areas.

Electric vehicle adoption would receive additional momentum through lower per-mile costs and VED exemptions.

Implementation Challenges and Timeline

Despite 15+ years of discussion, pay-per-mile road tax remains unimplemented due to significant practical and political challenges.

Technology infrastructure requires massive investment in tracking systems, enforcement mechanisms, and administrative frameworks.

Political feasibility faces obstacles from rural constituencies, essential service providers, and high-mileage voter groups.

Privacy concerns around government vehicle tracking need addressing before public acceptance becomes possible.

Transition mechanisms must account for existing vehicle financing, insurance structures, and regional disparities.

The government continues exploring options, but no concrete implementation timeline exists. Current discussions focus on pilot programs and gradual phase-in approaches rather than immediate wholesale changes.

Preparing for Change

While pay-per-mile road tax remains speculative, the trend toward usage-based charging appears inevitable. Smart vehicle owners are already positioning themselves by:

- Evaluating current driving patterns and identifying reduction opportunities

- Considering electric vehicle options for long-term cost benefits

- Exploring alternative transport options in their areas

- Understanding how different pricing structures might affect their specific situations

For those concerned about mileage tracking and its implications, staying informed about your options and rights remains essential as these systems continue evolving.

The shift toward pay-per-mile represents more than simple pricing changes; it’s a fundamental reimagining of how we approach vehicle ownership, urban planning, and transportation equity in modern Britain.

Leave a Reply